Financial success is not merely about earning a high income; it's about how one manages, invests, and grows that income over time. Many highly successful individuals share specific financial habits that contribute to their prosperity. This article examines these habits, focusing on the financial mindsets they cultivate, effective budgeting and saving strategies, wise investment practices, and the importance of continuous learning in adapting to changing economic landscapes.

Understanding Financial Mindsets

The financial mindset of successful individuals often sets them apart from others. This mindset encompasses beliefs, attitudes, and values regarding money and wealth. Successful people tend to view money as a tool that enables them to achieve their goals rather than as an end. Here are the critical components of their financial mindset:

Long-Term Vision

Successful individuals often think long-term, setting financial goals beyond immediate gratification. They understand the importance of planning for the future, whether it involves saving for retirement, funding education, or creating a legacy. This long-term vision helps them stay focused and disciplined in their financial decisions.

Positive Attitude Towards Money

Having a positive relationship with money is vital. Many successful people approach their finances optimistically, believing they can build wealth and achieve financial independence. This positive mindset fosters resilience, enabling them to bounce back from setbacks and remain committed to their financial goals.

Embracing Risk

Risk is an inherent part of financial growth. Highly successful individuals are willing to take calculated risks, understanding that opportunities for significant returns often come with some level of uncertainty. This willingness to step outside their comfort zones allows them to seize opportunities others might overlook.

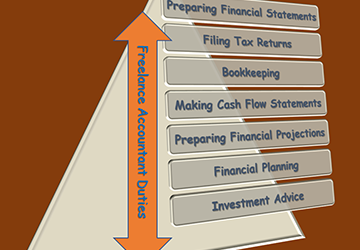

Value Of Financial Literacy

Successful people prioritize financial literacy. They invest time in understanding how money works, from budgeting basics to complex investment strategies. This knowledge empowers them to make informed decisions and navigate the financial landscape confidently.

Budgeting And Saving Strategies

Effective budgeting and saving are crucial components of financial success. Highly successful individuals often employ specific strategies to manage their finances effectively.

Creating A Detailed Budget

A comprehensive budget serves as a roadmap for managing income and expenses. Successful individuals meticulously track their spending, categorizing expenses to identify areas where they can cut back. They often use budgeting tools or apps to streamline this process, ensuring they stay on top of their finances.

The 50/30/20 Rule

Many successful people adopt the 50/30/20 budgeting rule, which allocates 50% of income to needs (essentials like housing and food), 30% to wants (discretionary spending), and 20% to savings and debt repayment. This simple framework helps them prioritize their financial obligations while allowing for some enjoyment.

Emergency Funds

Building an emergency fund is a common practice among financially successful individuals. They typically aim to save three to six months of living expenses in a separate account. This fund provides a safety net during unexpected financial setbacks, reducing stress and enabling them to make sound decisions.

Automating Savings

Automation simplifies the savings process. Successful individuals often set up automatic transfers from their checking accounts to their savings or investment accounts. By treating savings like a recurring expense, they ensure they consistently contribute to their financial goals without the temptation to spend that money.

Investing Wisely For Growth

Investing is a critical aspect of building wealth. Highly successful individuals understand the importance of making their money work for them through intelligent investment strategies.

Diversification

A well-diversified investment portfolio helps mitigate risk and increase potential returns. Successful investors spread their investments across various asset classes, such as stocks, bonds, real estate, and mutual funds. This strategy reduces the impact of a poor-performing investment on their overall portfolio.

Understanding Market Trends

Staying informed about market trends is essential for making wise investment decisions. Many successful individuals dedicate time to researching market conditions, economic indicators, and emerging industries. This knowledge allows them to identify promising investment opportunities and avoid potential pitfalls.

Long-Term Investments

Successful investors often adopt a long-term perspective, focusing on assets that appreciate over time rather than seeking quick profits. They understand that building wealth requires patience and the discipline to ride out market fluctuations. This long-term approach helps them avoid impulsive decisions driven by short-term market volatility.

Seeking Professional Advice

While many successful individuals are financially savvy, they also recognize the value of seeking professional advice. Consulting with financial advisors or investment professionals can provide valuable insights and help tailor investment strategies to align with individual goals and risk tolerance.

Continuous Learning And Adaptation

The financial landscape constantly evolves, and highly successful individuals understand the importance of continuous learning and adaptation. They remain committed to enhancing their financial knowledge and skills throughout their lives.

Embracing New Technologies

With the rise of financial technology (fintech), successful individuals often leverage new tools and platforms to manage their finances more efficiently. Whether using budgeting apps, robo-advisors, or online investment platforms, they embrace innovations that simplify financial management and improve decision-making.

Staying Informed About Economic Changes

Economic conditions can significantly impact financial decisions. Successful individuals stay informed about changes in interest rates, inflation, and monetary policies. This awareness allows them to adjust their strategies, capitalize on emerging opportunities, and navigate challenges effectively.

Networking And Learning From Others

Many successful people understand the power of networking. They engage with like-minded individuals, attending seminars, workshops, or networking events. Learning from others’ experiences and sharing insights helps them refine their financial strategies and broaden their perspectives.

Investing In Personal Development

Continual personal development is a hallmark of financial success. Many successful individuals invest time and resources to acquire new skills through formal education, online courses, or self-study. This commitment to growth enhances their financial acumen and contributes to their overall success in life.

Conclusion

The financial habits of highly successful people reflect a combination of sound economic principles, practical strategies, and a commitment to continuous learning. Individuals can work towards achieving their financial goals by cultivating a positive financial mindset, employing disciplined budgeting and saving techniques, making informed investment choices, and embracing lifelong learning. Adopting these habits can set anyone on the path to financial success, regardless of their starting point. Ultimately, it's about making informed choices that align with personal goals and values and fostering a healthy relationship with money that leads to lasting prosperity.