Establishing an emergency fund is a pivotal step towards achieving financial resilience. It enables you to manage unforeseen expenses without relying on credit. This guide elucidates the process of starting an emergency fund, methods for building emergency savings, and tips for emergency fund sustenance. Segmenting the approach into practical steps makes constructing a robust financial buffer achievable.

Grasping the Significance of an Emergency Fund

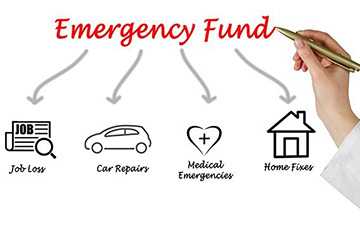

The first step is to grasp why an emergency fund is indispensable. This bulwark fund covers sudden financial demands such as unexpected medical expenses, critical home repairs, or abrupt employment disruptions. Establishing this fund safeguards against debt and instils a sense of economic security.

Crafting Your Emergency Fund Blueprint

Calculating Your Financial Buffer

Initiating your emergency fund begins with determining your financial cushion. Typically, it's advisable to accumulate three to six months' worth of essential living costs. Assess your monthly expenditures comprehensively to understand the sum you should target.

Segmenting Your Financial Targets

If the ultimate goal seems overwhelming, divide it into smaller, attainable milestones. Start by securing a fund that can cover one month of expenses, then methodically expand to three months, progressing steadily towards your goal.

How to Build an Emergency Savings

Initiating Incrementally

For those pondering how to build emergency savings, begin modestly. Even saving a minimal amount, such as $50 to $100 monthly, can accumulate substantially over time. Enhance your savings effortlessly by arranging an automatic transfer from your paycheck to a dedicated emergency fund account, ensuring consistent savings without regular attention.

Selecting an Optimal Savings Account

Opt for a high-yield savings account tailored to your emergency fund. Seek features that combine easy access without penalties, competitive interest rates, and minimal fees; this facilitates more rapid growth of your funds and ensures accessibility when needed.

Tips for Emergency Fund Stewardship

Routine Evaluations and Adjustments

An emergency fund management tip is to assess and modify your savings contributions regularly. As your financial circumstances evolve, such as receiving a salary increment or settling debts, consider enhancing your contributions to reach your target swifter.

Safeguarding Your Fund

It's crucial to preserve your emergency fund strictly for unplanned expenditures. Please resist the temptation to utilize it for non-emergent needs. Maintaining your emergency fund separately from your regular accounts can help prevent impulsive spending.

Fortifying Financial Stability Through Savings

Implementing Savings Challenges

Boost your savings by introducing personal challenges, like a week-long spending freeze or reducing specific expenditures, such as entertainment. Redirect the conserved funds directly to your emergency fund.

Gradual Enhancement of Savings

Another beneficial tip for emergency fund growth is to increase your savings gradually. Whenever you acquire unexpected financial gains—a tax rebate, bonus, or a monetary gift—allocating a fraction to your emergency fund can significantly bolster your reserves.

Augmenting Your Emergency Fund with Strategic Foresight

Emphasize Strategic Contributions

To bolster your emergency fund, make contributions during financially prosperous periods. Pinpoint when your expenditures are minimal and direct the excess funds into your emergency reserves. This forward-thinking approach accelerates the fund's growth and ensures it is sufficiently stocked for future uncertainties.

Capitalize on Unexpected Financial Gains

Make the most of sudden financial windfalls, such as inheritances or substantial sales bonuses, to significantly enhance your emergency fund. Redirecting these serendipitous earnings into your emergency savings can swiftly boost your progress toward a solid financial buffer.

Revolutionary Approaches to Emergency Fund Allocation

Segmenting Your Savings into Dedicated Reserves

Consider partitioning your emergency fund into distinct segments to address various financial contingencies, from health crises to urgent home repairs and sudden employment interruptions. This method lets you customize your savings, ensuring the appropriate funds are ready for emergencies.

Implementing Cutting-Edge Saving Mechanisms

Embrace state-of-the-art saving tools and applications that aid in financial accumulation. Utilizing features such as purchase round-ups or automated paycheck deductions helps gradually expand your emergency fund with minimal disruption to your daily budget.

Enduring Strategies for Sustained Savings

Adopt Lifestyle Modifications for Financial Health

Alter your daily habits to bolster your saving endeavours. Modest adjustments, like dining in more often, choosing economical entertainment options, and curbing unnecessary expenditures, can significantly increase your emergency fund contributions.

Persist in Financial Literacy

Stay informed about financial management through ongoing education. Comprehending the intricacies of budgeting, investing, and saving offers valuable knowledge that aids in effectively expanding and preserving your emergency fund.

Progressive Techniques for Enhancing Emergency Fund Growth

Escalate Contributions Concurrent with Salary Increases

With each salary increment, proportionally raise your contributions to the emergency fund. This stepwise enhancement aligns with your growing financial capability, expanding your safety net.

Optimize Your Insurance Strategies

Frequently assess your insurance plans—covering health, property, and vehicles—to confirm they provide comprehensive protection. Fine-tuning your coverage can minimize the need to utilize your emergency fund for insured incidents, thus maintaining it for other critical needs.

Methodical Withdrawal Protocols for Crisis Situations

Define Emergency Withdrawal Conditions

Establish explicit criteria defining what qualifies as an 'emergency' and the circumstances under which you can access your savings. These guidelines help preserve the integrity of your fund and prevent its misuse.

Develop a Replenishment Strategy

Formulate a strategy to restore your fund following any withdrawals; this may involve temporarily boosting your saving rate or reducing non-essential spending to replenish the used funds.

Exploring Supplementary Financial Resources for Emergencies

Consider Establishing a Credit Line

For those with a substantial emergency fund, setting up a line of credit may serve as an additional safeguard. This strategy provides a secondary layer of financial security, ensuring that your primary savings remain intact during crises.

Utilize Community and Social Aid

Investigate local and social resources available for emergency assistance. Community support services, charitable entities, and social welfare programs can offer necessary aid without draining your emergency savings.

Conclusion

Establishing an emergency fund is an essential stride in fortifying your financial future. You cultivate a substantial financial safeguard by diligently starting an emergency fund, mastering how to build emergency savings, and implementing sound tips for emergency fund management. The cornerstone of thriving emergency savings lies in consistent, disciplined efforts and an unwavering commitment to start, regardless of the initial amount.